🕵️♂️ The Hidden Role of Private Detectives in Keeping the Stock Market Clean

When Sherlock Holmes puts on a business suit. Just imagine this moment.

A CEO who is well groomed walks on a stage and he's got all the lights and camera upon him .He’s got all the buzzwords down: disruptive innovation, record-breaking profits, future-ready tech. On the surface, it’s all very slick.

But not everyone in the room is there to be impressed.

Somewhere in the crowd, a private investigator is watching. Not for the pitch, but for the cracks in it. Maybe they’ve already spoken to a disgruntled ex-employee who claims the numbers don’t add up. Maybe they’ve tracked flight logs showing the CEO was in Panama last month for a hush-hush meeting. They’re not buying the show—and they might be the only reason a billion-dollar scam never gets off the ground.

This isn’t a scene from a Netflix drama. In today’s financial world, Private Investigators in Ghaziabad are quietly becoming essential players in protecting the integrity of the stock market.

📉 Why the Market Needs People Watching from the Outside

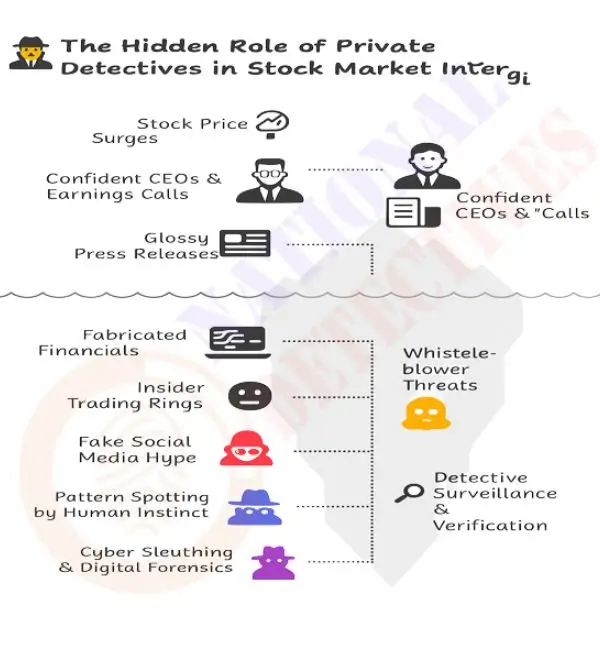

The global stock market isn’t just charts and algorithms—it reflects dreams, risk, and trust. But where there’s money, there’s always temptation. Insider trading, fake press releases, market manipulation, shady influencers—it’s a playground for deception.

Sure, regulators like SEBI and the SEC are doing their part. But let’s be honest—they’re buried under paperwork and bound by strict protocols. In the fast-paced world of high-frequency trading and viral stock movements, red tape moves too slow.

That’s where Private Investigators come in—agile, alert, and able to go places government officials simply can’t.

👀 Who’s Hiring These Financial Sleuths?

Surprisingly, it’s not just governments or compliance departments.

● Hedge funds that want to verify a company before writing a $100 million cheque.

● Legal teams trying to confirm whether a whistleblower’s story holds up.

● Journalists chasing a lead that smells fishy.

● Even individual investors coming together to sniff out a scam.

🔍 A True Story: The Green Tech Mirage

Say you’re about to invest in a startup claiming to have revolutionary carbon capture tech. The founder talks like they’re giving a TED Talk. The website looks slick. Everyone’s excited.

But something feels… off.

You call in a detective. Here’s what they dig up:

● The founder used a different name in a previous company that ended in fraud.

● The lab photos on the website? Staged. The equipment was borrowed from another firm.

● Their biggest “client” turns out to be a shell company owned by the founder’s cousin.

You just saved yourself from a $30 million mistake. All because someone took a closer look.

🛠️ How They Actually Do It

-

Forget the trench coat stereotype. Today’s investigators are more like digital ninjas than old-school spies. Here’s what’s in their toolbox:

-

Online Monitoring Tools – They scan platforms like Reddit, Telegram, and Twitter for early signs of coordinated market activity or fake news.

-

Data Cross-Referencing Software – They pull court records, offshore leaks, business filings—you name it. Then they connect the dots.

-

Talking to Real People – This is where the magic happens. Former employees. Suppliers. Even neighbors. People who’ve seen the truth up close.

-

Cyber Sleuthing – Following digital breadcrumbs, like suspicious logins or leaked files being passed around in shady corners of the internet.

🌍 Why It Matters Now More Than Ever

Let’s face it—this isn’t your grandfather’s stock market anymore.

● Fake news is created using AI.

● Influencers with zero financial training convince thousands to buy into nonsense.

● Fraudsters hide behind offshore companies and encrypted chats.

And regular investors? They’re trading during their lunch break, relying on YouTube tips or social media hype.

The result? A chaotic playing field where misinformation spreads faster than the truth—and the ones left holding the bag are usually the little guys.

🧠 It’s About More Than Just Catching Crooks

The Best Detectives In Delhi aren’t just scanning for scams—they’re reading people.

They know the signs:

● A CEO who micromanages earnings calls might be hiding something.

● A CFO who quits right before an audit? That’s never random.

● A founder who says “AI” and “blockchain” every second sentence, but has zero tech experience? Run.

They read between the lines. They ask questions no one else dares to.

-

🤝 The Whistleblower Bridge

Not all truth comes from data. Sometimes it comes from someone scared but honest.

Whistleblowers are the ones who take risks a lot in terms of career ,reputation and even safety.Thats where Private Detectives help.They verify the claims. They protect identities. They gather evidence quietly and connect insiders with legal backup when needed.

It’s delicate work. But it’s led to some of the biggest financial exposes in recent memory.

✈️ When Investigations Go Global

Money moves fast—and fraud moves faster.

Many detectives are working across the borders and having networks in places like Singapore, Switzerland and Dubai.They trace all the complex offshore company trails, follow the money involved and at the end figure out who’s really behind that mysterious fund.

They work in the shadows, where regulators can’t—or won’t—go.

🤯 Case File: The Meme Stock Mirage

Remember the GameStop craze? That was just the beginning.

Another stock surged after rumors of a buyout flooded Reddit. But a team of detectives traced the posts to a single marketing agency—paid by the company to generate hype. Fake accounts. Fake rumors. Real money lost by real people.

🧩Skills a Great Detective have

It’s not just about tools or knowledge—it’s about instincts.

Great financial Investigators are naturally curious. They don’t trust surface-level answers. They ask: “Who gains from this?”

They combine:

● Solid financial know-how

● Tech skills

● Strong people-reading abilities

● And above all—patience

They aren’t in it for credit or headlines. They’re the quiet force behind the scenes, making sure the system doesn’t collapse.

🚀 Humans still win over the ai tools

Sure, tools are evolving. Drones. AI pattern detectors. Sentiment trackers. All useful.

But in the end, it’s not the gadgets that crack the case—it’s the hunch, the conversation, the out-of-place sentence. It’s still about human instinct.

💬 In the End, It’s About Trust

Stock markets don’t run on money. They run on belief. The belief that the numbers are real, the leaders are honest, and the game isn’t rigged. Every time that trust is broken, the whole system trembles.

Hire Private Detectives in Gurugram might never stand at the podium. But they’re the ones behind the curtain, catching the cracks before the building collapses. They’re the reason shady IPOs get stopped, and why some of the biggest scams in history never even happen.