- service@nationaldetectives.in

- +91 8800462341

We work with ambitious leaders who want to define the future, not hide from it.

Blog Detail

- Home

- Blog

- National Detectives

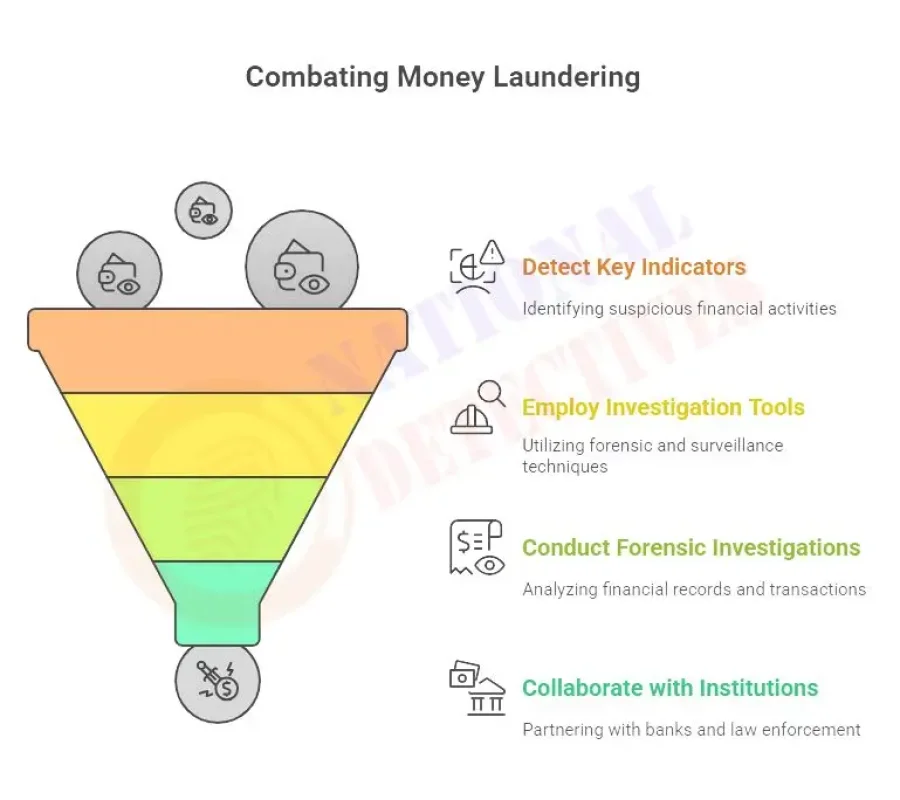

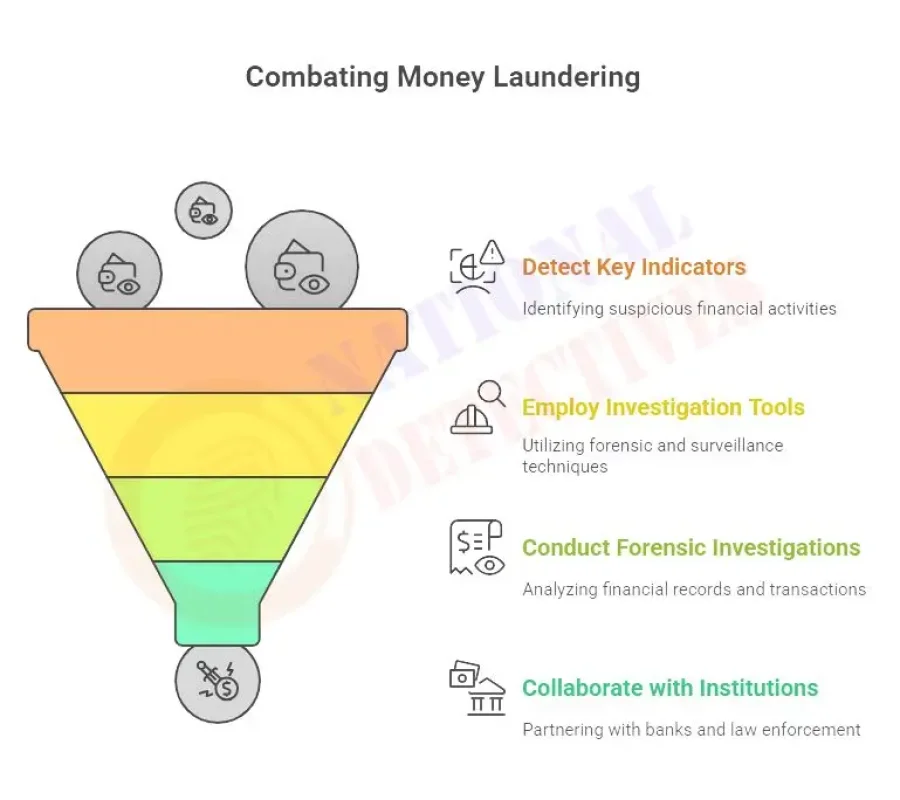

How Private Investigators Effective Combat Money Laundering

Money laundering is one of the most pervasive, complex financial crimes threatening global economic security, fuelling drug trafficking, terrorist activity, human trafficking, corruption and tax evasion. Governments and financial institutions continually update compliance measures; private detectives play an effective role in investigating and stopping money laundering schemes.

This article details how private detectives assist in combatting money laundering by employing various tools, recognizing key indicators, and becoming increasingly trusted partners of corporations, banks and law enforcement agencies for high-stakes investigations.

What Are My Definition of Money Laundering Options?

Money laundering (ML) refers to the practice of disguising illegally obtained funds by passing them through various banking transfers or commercial transactions in an effort to disguise its source and conceal its true nature. Typically this involves three stages:

•Placement - Transferring illegal funds into the financial system through banks, casinos or shell companies.

•[Layering] - Disguising their source by moving it around through multiple transfers, offshore accounts and cryptocurrency wallets.

•Reintegration - Reintroducing laundered funds back into the economy as legitimate forms of revenue (such as real estate investments or business investments).

Private Detectives In Delhi can play an invaluable role in following money trail activity through each step, which often involve deceit, forgery and cross-border transactions - so private investigation remains one of the primary tools available for following it back to source.

Private Detectives Have an Important Role to Play in Anti-Money Laundering (AML)

Exposing Shell Companies and Fake Entities

One of the primary methods for money laundering involves creating shell companies -- firms which exist on paper but lack real business operations -- for cash flows that do not directly correspond with real profits or losses.

Private detectives provide services such as investigating company registration documents; verifying physical office addresses and staff; analyzing financial filings and bank statements for potential violations; as well as uncovering beneficial ownership behind corporate veils.

Financial institutions and law enforcement agencies use this technique to quickly identify companies whose sole function is moving or concealing illegal funds.

Forensic Financial Investigations

Experienced investigators possessing financial forensics expertise can:

As part of its banking transactions analysis, The FSA looks out for suspicious patterns; detect structuring (smurfing), where large transactions are broken into smaller amounts; track unexplained wealth or asset accumulation and collaborate with auditors in flagging noncompliant or high risk accounts

By working alone or alongside forensic accountants, they connect the dots between front-end business activities and hidden illicit sources.

Surveillance and Undercover Operations

In many high-value laundering cases, suspects use intermediaries or runners as part of their laundering schemes. Detectives conduct:

Covert surveillance of suspects, properties or businesses Undercover operations to engage suspects or monitor cash flows

Monitoring real estate deals, luxury purchases or lavish lifestyles.

These techniques produce actionable evidence rather than mere data, providing greater value than pure numbers could.

Conduct Background Checks of Individuals at Risk

Private detectives are frequently hired for investigations:

POLITICALLY EXPOSED PEOPLE High net-worth individuals with dubious sources of income Suspicious vendors, clients or partners in international deals Bank customers flagged for AML concerns

Detectives perform due diligence investigations on criminal and civil records, past bankruptcies, offshore ties and any unusual business conduct to compile detailed due diligence reports.

Cryptocurrency Investigations

As cryptocurrency becomes an increasingly attractive means for money laundering, private investigators are developing tools to combat it.

Trace blockchain transactions Locate crypto wallet holders through exchange KYC leaks or OSINT Collaborate with cybercrime units in monitoring darknet markets and mixers

Keep tabs on conversion rates between fiat currency and crypto

Their expertise combining digital forensics and field investigation makes them invaluable assets in AML efforts related to crypto.

Asset Tracing across Borders

Money laundered through fraudulent schemes is used to purchase real estate, luxury cars, jewelry, art and overseas investments - areas in which detectives specialize in.

Locating or identifying undervalued Asset Investigation offshore holdings and foreign bank accounts Analyze sudden wealth among politically exposed persons (PEPs). Assist with asset recovery proceedings or legal seizures.

Their reports assist law firms and enforcement bodies in recovering stolen wealth as well as creating legal cases against economic offenders

Tools and Techniques Used by Private Detectives

Private investigators use both traditional field methods and modern technological solutions, including:

•Public records searches (ROC filings, land registries and company registries); OSINT tools used for social media monitoring or press mentions; and

•Link analysis software which maps relationships among people, companies and accounts

•Artificial Intelligence and Machine Learning for pattern detection. Collaboration with Forensic Auditors and Cyber Experts.

•These tools equip detectives to uncover networks of fraud, detect money mules and locate ultimate beneficiaries.

Use of multiple companies for small, high-frequency payments

Significant property purchases without known sources of income [Treasuries, banks or insurance firms]. Donations or financial gifts without explanation (donations of large sums to nonprofit organizations etc), unregistered money lenders or businesses containing large sums in cash (CASH-LOANS/ CASH-HEAVY businesses etc).

Employing family or employees as "name lenders", making frequent international transfers without providing evidence of legitimate trading activity is common practice.

These indicators often trigger further investigation for potential AML violations.

Who Hires Private Detectives for Anti-Money Laundering Investigation?

Banks and Financial Institutions Law Firms Corporations and Municipalities, enhanced due diligence (EDD), legal support or prosecution, civil or criminal prosecution against economic crimes (economic crimes), Corporation vetting clients suppliers and M&A targets and Government Agencies utilizing covert intelligence/pre investigation data for covert intelligence or pre investigation data.

Real Estate Developers and NGOs and Watchdogs can play key roles in screening buyers or sellers involved in high-value deals whilst NGOs and Watchdogs investigate corruption and illicit finance activity.

Tracing Black Money Through Real Estate in India: Case Analysis

A legal firm hired an Indian private detective agency to probe an allegedly politically connected individual suspected of laundering Rs50 crore through real estate deals and cash deals.

Steps Taken: We conducted ownership history checks on 12 properties located across Delhi and NCR; traced payments back to shell companies connected with Dubai-based entities, used drone surveillance footage to detect occupancy patterns as well as utility bills to identify occupancy patterns; identified numerous properties purchased using employee names as evidence and discovered additional ones were registered under employee names for purchase.

Outcome: Following their report, this agency initiated an ED (Enforcement Directorate) investigation and provisional property attachment under the Prevention of Money Laundering Act (PMLA).

Legal Boundaries and Compliance Requirements for Healthcare IT Systems

Private investigators do not fall under law enforcement, however their work must abide by certain Indian regulations such as:

PMLA 2002, Information Technology Act 2000 and Companies Act 2013 are some key pieces of law which protect a number of interests: Parachute Code Act (IPC), Foreign Exchange Management Act (FEMA)...

Professional agencies ensure all investigations conducted are discrete, ethical and legally admissible in court proceedings.

AI and Predictive Analytics Take Center Stage in Business Development --- (Information Age, Feb 2, 2019 ).

Modern AML investigations increasingly rely on:

AI-driven anomaly detection NLP to scan emails, contracts and chats for red flags Real-time monitoring dashboards Predictive models to identify high risk clients or vendors

Private detectives armed with such technologies can more efficiently detect, prevent and document instances of money laundering.

For this example to work properly, an image file needs to be included for every frame in which textual material needs to be read and deciphered.

As money launderers continue to develop their methods of money laundering, so must those investigating them. Private detectives play an indispensable part in stopping dirty money flow: from investigating suspicious investors and tracking down properties purchased with black money purchases to monitoring offshore Shell Companies Detection that send off funds, their expertise is an indispensable necessity in keeping dirty funds at bay.

With proper tools, training, and ethical practices in place, Private Investigators remain key players in fighting global financial crime.